The US banking sector awaits historic regulatory easing.

They plan to reduce capital requirements for banks in the US

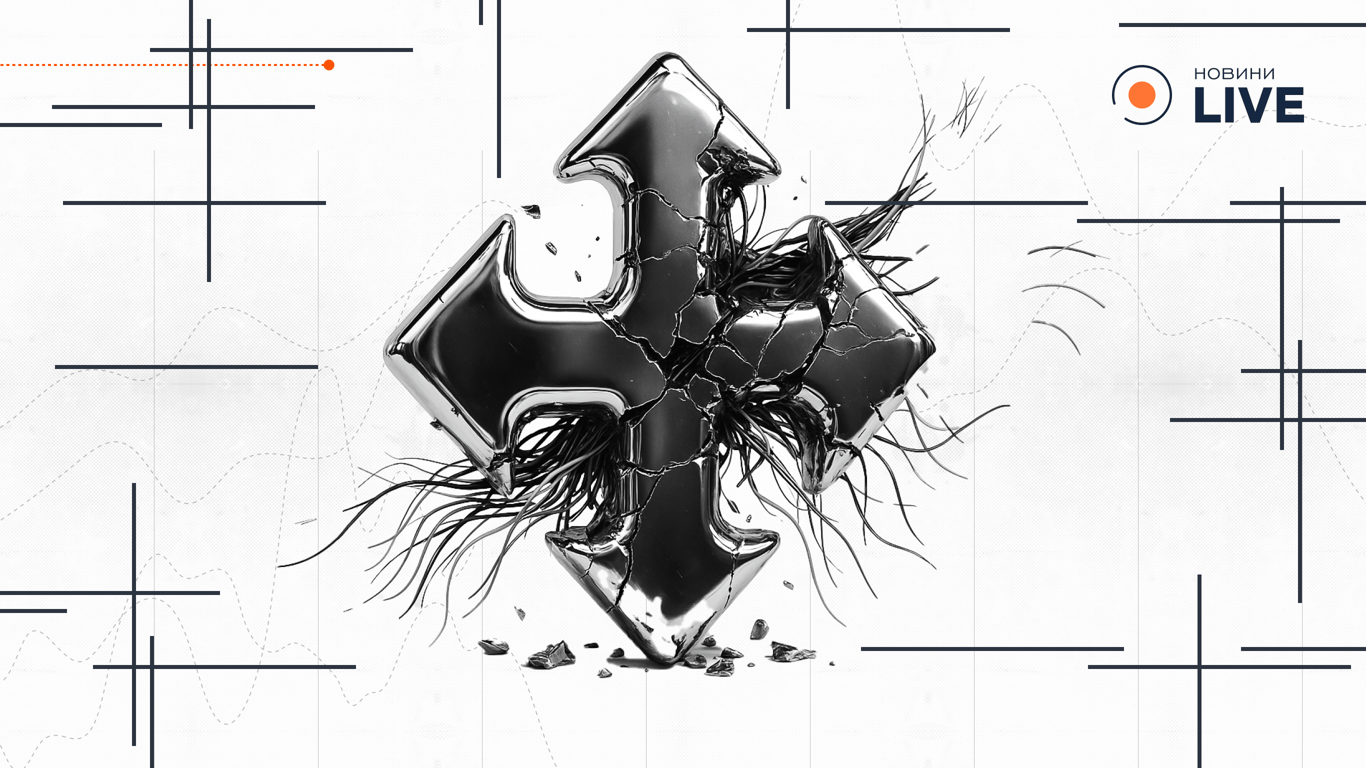

American regulators are preparing for one of the largest reductions in capital requirements for banks in the past decade. According to the Financial Times, they plan to lower the supplementary leverage ratio (SLR), introduced in 2014 after the 2008-09 financial crisis, in the coming months.

This ratio requires large banks to hold a certain amount of high-quality capital against all assets, including off-balance-sheet assets. Banking lobbyists have long criticized this rule as an excessive restriction on financial institutions.

Reform proposals are expected to be announced by summer 2025, and there is also consideration of temporarily excluding low-risk assets, such as Treasury bonds and central bank deposits, from the SLR calculation. The eight largest banks in the US currently must hold a Tier 1 capital ratio of at least 5% of total leverage. Experts believe that returning the exemption for 'safe' assets could free up to $2 trillion from the balances of these banks.

Critics consider this initiative risky due to the instability of financial markets, as well as the possibility of setting a precedent for similar requirements in Europe and the United Kingdom.

Analysis

Cutting capital requirements for banks can have both positive and negative impacts on the financial system. On one hand, it could stimulate the development of the banking sector and the economy as a whole through greater operational flexibility. On the other hand, reducing requirements could increase risks to financial stability, especially during periods of economic instability. Therefore, it is important to balance these two aspects when implementing such reforms.

Read also

- Prices have soared - how much will a cosmetic renovation of an apartment cost

- Cherry, tomatoes, and watermelons — how much do Odessa residents pay for them

- The Cultural Code of Money - How the Past Influences Finances

- Parking spaces in Kyiv - how prices have changed and what to expect

- Mass Layoffs at Nova Poshta 2025 — What AI is Changing in the Job Market

- No chance — which dollars and euros are confiscated immediately in exchange offices