The Ministry of Finance and the National Bank conducted the first switch auction on the Bloomberg platform.

The first auction for the exchange of government bonds was conducted using Bloomberg

The Ministry of Finance and the National Bank of Ukraine held the first auction for exchanging government bonds on the domestic market using the Bloomberg platform. This innovation will facilitate the management of public debt and liquidity.

Switch auctions allow for the exchange of old government bonds for new or less liquid securities. This helps to smoothly distribute debt repayment and ensures more effective liquidity management.

Ukrainian auctions through Bloomberg have been conducted since 2019. The auction that took place on February 19 was the first to apply the new platform feature that allows market participants to exchange government bonds for new securities within a single transaction.

Yuriy Butsa, the Government Commissioner for Public Debt Management, noted that switch auctions are an important step in the development of the Ukrainian government bond market and in aligning with international standards.

Katherine Furber, Global Head of Trading Products in Emerging Markets at Bloomberg, emphasized the importance of implementing the improved switch auction feature for issuers in the primary market.

The Bloomberg platform is used for conducting bond auctions in an electronic format and provides a secure environment for operations in the open market. It is integrated with the information and analytical tools of Bloomberg Terminal and is used in many countries around the world.

Read also

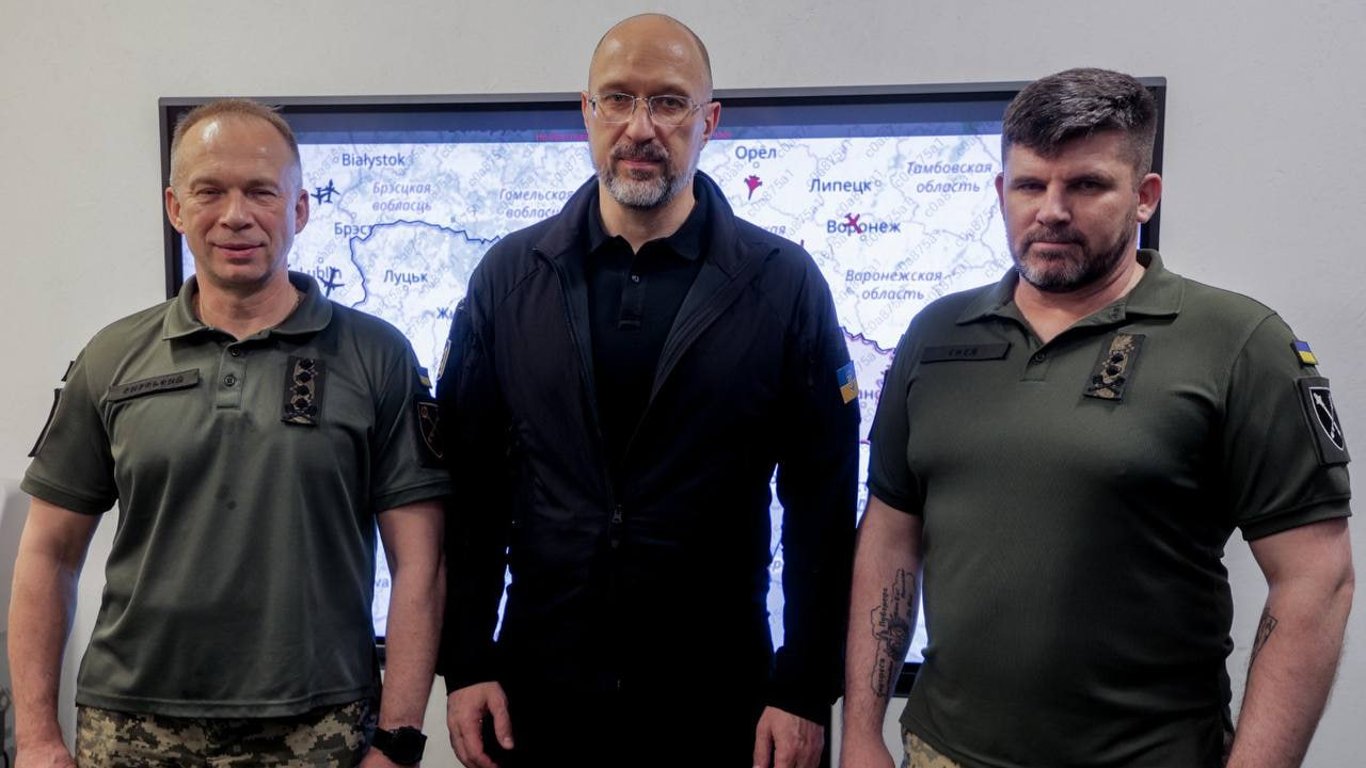

- Shmyhal met with Syrskiy and Hnatov — what they talked about

- MP responded about what to expect from the new head of the Ministry of Energy

- The USA Returns to 'Ramstein' — Evening.LIVE Broadcast

- Britain has imposed sanctions against the missile spotters in Mariupol

- A woman who praised the Russian Federation was beaten in Kyiv - what is known about the scandal

- Operation at Boyko Towers - details of mission execution